|

|

|

Last Updated: Aug 28th, 2015 - 18:38:04 |

Petrojam Limited is a limited liability company established in 1982. It is currently owned jointly by Petroleum Corporation of Jamaica (51%) and PDV Caribe (49%). The latter initially invested in Petrojam in 2006 and in 2008 it paid US$63.5m to acquire the 49% stake.

Hedging

A Hedge is basically an insurance acquired to reduce the risk of adverse price changes against an underlying asset. It is not intended for speculation but to protect the value of the asset if the insured event happens. Generally speaking, the cost of the hedge or premium is an expenditure for which there is no expected return or yield.

There are different kinds of hedging instruments and strategies but for the purpose of this article we will elaborate on “options”, specifically “call options”. This is an agreement that gives the buyer the right but not the obligation to buy an asset at a specified price (strike price) within a specified time. The type of call option being alluded to is the most basic, referred to as a vanilla option.

Jamaica’s oil hedge

Finally, Jamaica has decided to take the plunge in hedging crude oil prices. The facts are sketchy and patchy and the members of the technical committee undisclosed except that it is chaired by Michael Hewett of Petrojam.

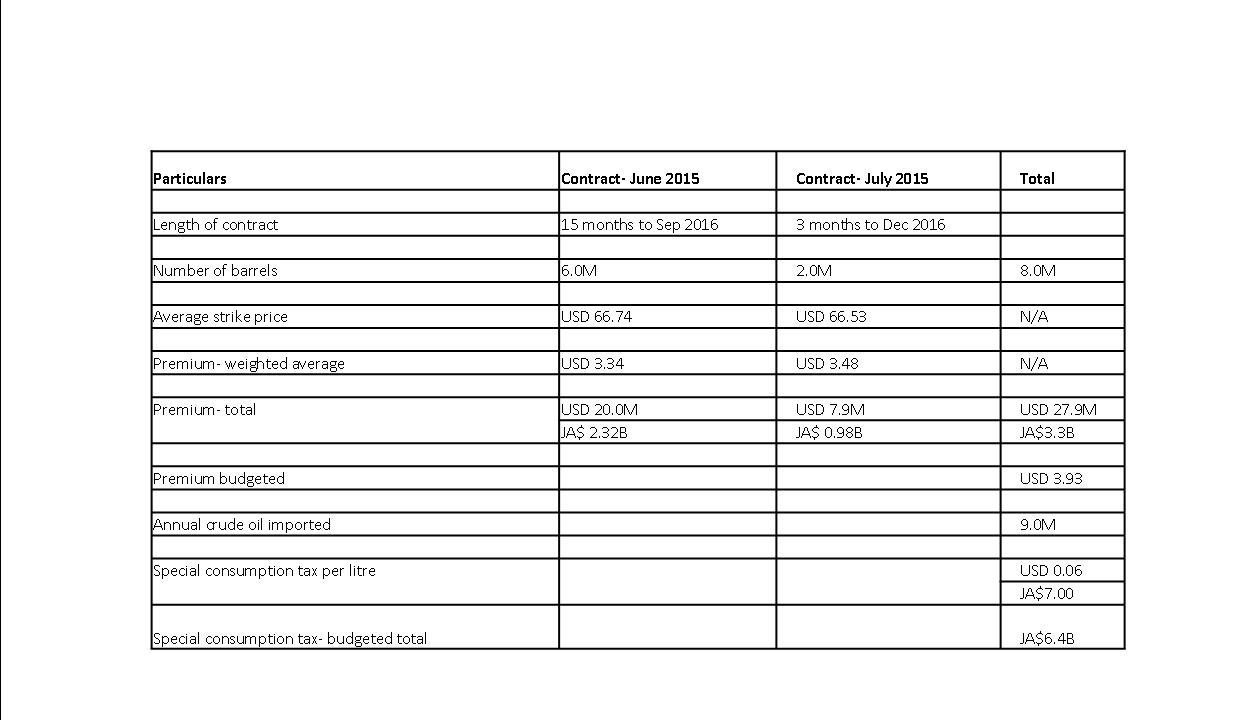

The following facts have so far been spilled:

|

| Crude tax |

JA$5.00 out of every JA$7.00 collected will go to the hedging initiative and excess funds will flow into a dedicated sub account at the Bank of Jamaica (BOJ) and administered by the Development Bank of Jamaica (DBJ) in conjunction with the Ministry of Finance (MOF).

Technical or political committee

The identity, but more importantly the qualification and experience, of members of the technical committee is irrelevant at this point as their performance to date says it all.

Hedging 101

a. Do not hedge big chunk of your risk all at once. In the space of two months Jamaica has hedged almost 90% of their annual crude oil requirement.

b. When prices are declining be careful in trying to catch a falling knife. The drop is West Texas Intermediary (WTI) was not as steep as in 2009 when it fell from USD140 to USD45 in approximately 6 months, the climb thereafter was gradual after retracing to USD70 in short order, then took 2 years to get above USD100 per barrel. This time the price fell from USD105 to USD48 again in about 6 months, quickly retraced to USD60 and recently touching USD40 per barrel.

c. Understand the impact of geopolitical factors on oil prices: Iran nuclear negotiation, fracking and the Organization of Petroleum Exporting Countries (OPEC) strategy, and state of the global economy.

Citi tax

Let’s be clear about Citibank though, they have done a marvellous job as the counterparty to the deal. As a former employee of Citibank Brian Wynter, the governor of BOJ, I hope had excused himself from the deliberation surrounding the selection of the counterparty.

The Jamaican tax payer and ultimately the consumer has been duped twice, taxed at $7 for $5 of purported value only to see it frittered away through incompetence as these contracts are currently out of the money and will likely expire worthless.

PNP and the market economy

In a market economy suppliers must do what it takes to be competitive and hedging whether currency or crude oil prices is part of managing the risk of business. Government has no responsibility or obligation to burden tax payers with additional taxes to mitigate these risks.

Petrojam as a for-profit entity should hedge crude oil from their own resources and profit or lose from their decision. While the price contracted by Petrojam affects the country in terms of foreign exchange it is no different in principle from the price of wheat contracted by Jamaica Flour Mills.

The People’s National Party (PNP) has a socialist tendency that does not fit in a market economy.

Whose loss is it anyway

In 2008/2009 Petrojam reported net loss of JA$4.7b including more than JA$3.0b foreign exchange losses. The foray into hedging has cost tax payers JA$3.3B in two months, and they don’t even know who it is that got them into it. Had Petrojam undertaken this on its own, as it should be, somebody would be held accountable; this is scandalous.

Robbing Paul to pay Peter

Minister of Finance, Dr. Peter Phillips has turned the table with an ingenious tax. From conception, the idea of this scheme was for 30- 35% of the tax to be siphoned off for undeclared purposes. It is plainly wrong and unconscionable for the government with its power to tax to use it as a conduit for private gain.

JA$6.4b of special consumption tax or more conservatively JA$3.3b or USD27.9m of hedge premium could do a lot of good things in the health sector like buy 750 dialysis machine or 60- 64 slice CT scanners. Citizens of this country must demand the revocation of overseas health care for all present and former ministers of government and their immediate families; they were elected to serve not to be served at tax payers’ expense.

____________________________________________________________

Source: Jamaica Gleaner, Wikipedia

© Copyright 2004 by

PayPerEditor.com

Top of Page

|

|

|

Latest headines.

|